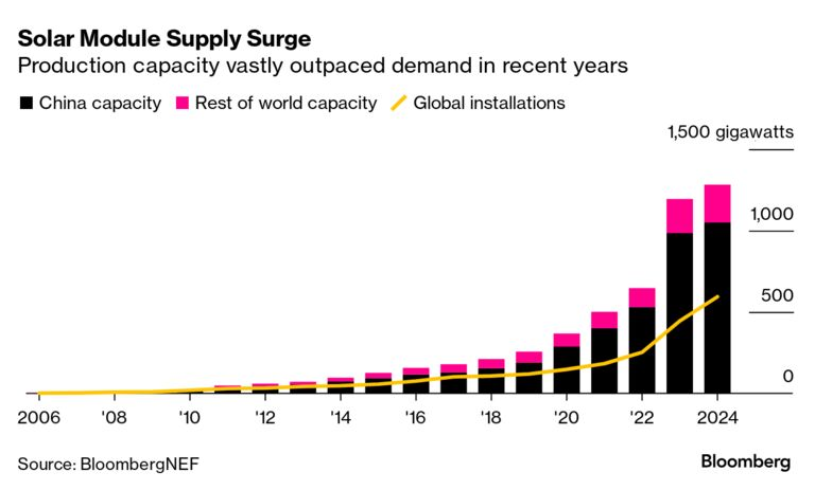

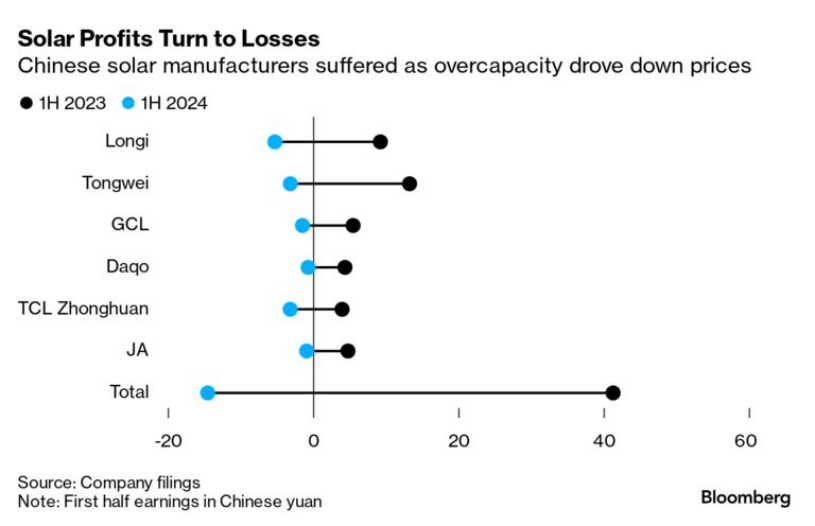

After experiencing a bloodbath of an earnings season, China’s solar manufacturers may begin to alleviate the huge oversupply that has plagued the industry. Due to the overcapacity caused by the factory construction boom in the past few years, 6 top Chinese solar firms suffered a total loss of $2 billion in the first half of this year, while some smaller companies have been forced to restructure.

In addition, the growing US-China rivalry is also making life more difficult for Chinese manufacturers. Washington is planning to double the import tariffs on Chinese solar equipment to 50% and target Chinese companies setting up factories in Southeast Asia.

And the trade relationship between China and the European Union is also deteriorating, with the EU being the main market for Chinese solar equipment.

Chinese manufacturers are dealing with the uncertainty brought by poor profitability and market access restrictions in the United States and the European Union stated by Goldman analysts including Trina Chen in a report this month. The Chinese solar energy industry is entering the final stage of a downward cycle and may bottom out in 2025.

Several executives from top Chinese companies have requested central government intervention to help the industry regain its footing. The proposed rectification measures include standardizing which new factories can be built, cracking down on less-efficient facilities, limiting price reductions, and promoting integration.

However, Morgan Stanley analysts such as Eva Hou stated in a report that it will take another 6 to 12 months for prices to rise back to break-even levels for solar firms. Furthermore, the industry either needs to further reduce production costs or strengthen capacity integration in order to bring supply chain prices back to sustainable levels.

No matter where you are, we are committed to providing you with global services!